Blog

Read our latest blogs...

What Should We Call a Collection of Digital Wallets? A Gaggle, A Fleet, A Bunch, A Cluster, A Chain?

With countless digital wallets available today, the challenge of interoperability remains significant. Learn how Empowch is paving the way for seamless transactions across different platforms, simplifying digital payments, and fostering financial inclusion along the way.

What Should We Call a Collection of Digital Wallets? A Gaggle, A Fleet, A Bunch, A Cluster, A Chain?

With countless digital wallets available today, the challenge of interoperability remains significant. Learn how Empowch is paving the way for seamless transactions across different platforms, simplifying digital payments, and fostering financial inclusion along the way.

For fintech businesses operating in or looking to expand into the MENA region, understanding and overcoming the complexities of cross-border payments is crucial. Empowch's tailored solutions can streamline this process, offering compliance, reduced fees, and seamless integration.

Empowch: Paving the Way Towards Financial Inclusion

Financial inclusion remains a global challenge, with 1.4 billion adults unbanked and many more underserved. In this article we explore how innovative digital technology can bridge this gap, offering mobile-first solutions, self-custody wallets, cross-border payments, and financial literacy initiatives.

The Evolution of Gaming

Discover the captivating history of gaming and its evolution into a multi-billion dollar industry, intertwined with innovative payment solutions. Empowch is at the forefront, powering the future of gaming payments with blockchain technology. Join us in revolutionizing the industry!

Discover how Bankey's latest innovation, Shaheen, breaks down barriers in the financial world with its groundbreaking interoperability. From streamlining transactions for businesses to offering cross-platform services for banks, Shaheen is driving a new era of financial inclusivity and efficiency.

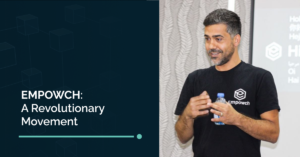

In a world where financial inclusion is often out of reach for many, Empowch emerges as a beacon of hope. Their revolutionary digital currency wallet, powered by blockchain technology, is reshaping how we manage and access money.

In a world rapidly moving towards digitalization, the financial sector stands at the cusp of a significant transformation. Amidst this evolution, Empowch aims to redefine the essence of financial transactions on a global scale. Powered by the groundbreaking potential of blockchain technology, Empowch’s vision is to enable seamless interoperability among local wallets worldwide.

In today's digital age, access to financial services is essential for economic empowerment and inclusive growth. Unfortunately, millions of people around the world are excluded from the traditional banking system. However, there is a glimmer of hope on the horizon. Empowch, a pioneering fintech company, is revolutionizing the landscape with its Digital Dollar Account, aimed at unlocking the financial potential of the unbanked.

The Future of Digital Wallets: Navigating Interoperability in a Fragmented Landscape

Digital wallets have become indispensable in our cashless society, but the lack of interoperability poses challenges for users. Empowch are leading the way in addressing these challenges. Empowch, in particular, focuses on simplifying transactions between different payment apps and rails, benefiting both individuals and businesses.

Empowering Peoples' Pockets

Empowch™, Empowch.com™ are trademarks of Bankey, LLC.

Copyright © 2024 Bankey, LLC

All Rights Reserved.

All other trademarks are the property of their respective.